Automotive Wiring Harness Market to Hit $121.3B by 2033: Trends & Forecast

Explore the electric world of automotive wiring harnesses! These electronic commodities provide the first component that powers electric cars as they speed through city streets, or autonomous vehicles as they navigate. Automotive Wiring Harnesses are propelling modern day mobility and this blog will provide an insightful commentary on the automotive wiring harness market regarding the size, growth, trends, applications, regulations, challenges, and future opportunities. Get ready for an engaging overview of an industry driving the transformation of mobility from 2025-2033.

Overview of the Automotive Wiring Harness Market

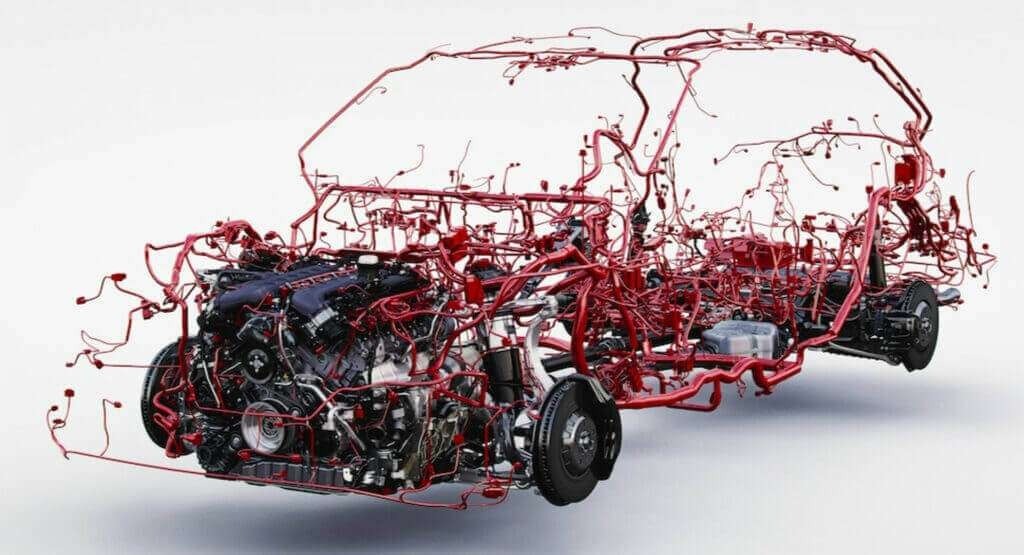

Think of a vehicle as a living and breathing creature, and its wiring harnesses as its nervous system. The wiring harnesses embody tightly bundled wires, connectors and terminals that transmit power and data to every component from headlights to infotainment systems. As vehicles become more sophisticated with new technology such as electric propulsion, and autonomous driving, the need for wiring harnesses is even more critical as they are now adapted to high voltage requirements and complex electrical architectures.

Wiring harnesses reduce vehicle build time, increase reliability, and mitigate the risk of electrical failures. Their relevance applies to all forms of vehicles, including passenger, commercial, as well as two-wheelers, and can extend to engine systems, chassis, air conditioning, and safety applications. The automotive industry's ongoing push for electrification, connectivity, and sustainability has provided the market for wiring harnesses with four significant streams of revenue, driven by consumer demand, and Government regulatory requirements.

- Core Function: Bundles wires to transmit power and signals, ensuring seamless operation of vehicle systems.

- Versatile Applications: Supports lighting, sensors, infotainment, ADAS, and powertrains across vehicle types.

- Market Drivers: Rising adoption of electric vehicles (EVs), advanced driver-assistance systems (ADAS), and connected car technologies.

- Global Reach: Dominated by Asia Pacific, with significant growth in North America and Europe due to EV and autonomous vehicle advancements.

Market Size & Growth

Global automotive wiring harness market size was valued at USD 86.5 billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 121.3 billion by 2033, exhibiting a CAGR of 3.44% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 46.7% in 2024. This steady growth reflects the industry’s response to electrification, advanced vehicle features, and the need for lightweight, efficient wiring solutions.

Several factors fuel this expansion. Surging EV sales, projected to exceed 17 million units globally by 2024, demand high-voltage wiring harnesses to manage complex electrical systems. Meanwhile, the integration of ADAS and infotainment systems in conventional vehicles increases the need for sophisticated data transmission capabilities. Asia Pacific’s dominance stems from cost-effective manufacturing, robust automotive production in countries like China and India, and government incentives for EV adoption.

- EV Boom: High-voltage wiring harnesses are critical for battery packs, electric drivetrains, and charging systems.

- Regional Leadership: Asia Pacific’s 46.7% share is driven by China’s EV market and India’s two-wheeler production.

- Growth Catalysts: Stringent emission regulations and consumer demand for connected, tech-laden vehicles.

- Investment Surge: Automakers and suppliers are pouring billions into R&D for innovative wiring solutions.

Key Trends in the Automotive Wiring Harness Market

Innovation electrifies the wiring harness market, with trends reshaping design, materials, and functionality to meet modern vehicle demands. Here are the pivotal trends driving the industry forward:

Lightweight Materials for Efficiency

Weight reduction is a priority in automotive design to boost fuel efficiency and EV range. Traditional copper wiring, while reliable, adds significant weight. Manufacturers are shifting to lightweight alternatives like aluminum and advanced composites, which can reduce wiring weight by up to 50%. For example, a leading EV manufacturer replaced copper with aluminum harnesses in its latest model, enhancing range without compromising performance. This trend aligns with global sustainability goals and emission regulations.

High-Voltage Systems for EVs

Electric vehicles require robust high-voltage wiring harnesses to connect battery packs, inverters, and motors. Unlike traditional low-voltage systems, these harnesses handle up to 800 volts, demanding superior insulation and thermal management. A case study from a German automaker highlights the development of modular high-voltage harnesses, enabling scalable designs for multiple EV models. This trend supports the projected rise in EV sales and charging infrastructure expansion.

Smart and High-Speed Data Transmission

Connected cars and autonomous vehicles rely on rapid data exchange between sensors, cameras, and electronic control units (ECUs). Wiring harnesses now incorporate high-speed Ethernet cables and fiber optics to support bandwidth-intensive applications like ADAS and vehicle-to-everything (V2X) communication. For instance, a Japanese supplier introduced fiber-optic harnesses for a luxury sedan, enabling seamless 5G connectivity and real-time navigation updates. This trend caters to the growing demand for smart, data-driven vehicles.

Modular and Flexible Designs

Modular wiring harnesses allow manufacturers to upgrade specific sections without overhauling entire systems, reducing costs and facilitating technology integration. A U.S.-based truck manufacturer adopted modular harnesses for its hybrid fleet, enabling easy retrofitting of ADAS features. This flexibility is crucial for adapting to rapid advancements in automotive technology and meeting diverse market needs.

Sustainable Manufacturing Practices

Sustainability is a buzzword in the automotive industry, and wiring harness manufacturers are embracing eco-friendly materials like bio-based plastics and recyclable polymers. A European supplier partnered with a recycling firm to produce harnesses with 30% recycled materials, cutting carbon emissions by 15%. Automation in manufacturing also enhances efficiency, reducing waste and energy consumption. This trend aligns with regulatory mandates and consumer preferences for green vehicles.

Industry Applications

Wiring harnesses are the lifeline of various vehicle systems, with applications spanning multiple domains. Each application demands tailored designs to ensure performance, safety, and reliability.

Chassis Wiring

Chassis wiring harnesses dominate the market due to their role in integrating advanced electronics for suspension, steering, and braking systems. These harnesses support ADAS features like adaptive cruise control and lane-keeping assist, requiring high-speed data transmission. For example, a South Korean automaker enhanced its SUV lineup with chassis harnesses supporting real-time sensor data, improving safety and handling.

Engine Wiring

Engine wiring harnesses power critical components like fuel injectors, ignition systems, and sensors. In EVs, they connect electric motors and battery management systems. A Chinese EV startup optimized its engine harnesses to reduce energy loss, boosting vehicle efficiency by 5%. This application is vital for both internal combustion engine (ICE) vehicles and electrified powertrains.

HVAC Systems

Heating, ventilation, and air conditioning (HVAC) systems rely on wiring harnesses to control climate settings and ensure passenger comfort. Luxury vehicles, in particular, demand complex HVAC harnesses to support multi-zone climate control. A European luxury brand integrated smart HVAC harnesses with IoT capabilities, allowing remote temperature adjustments via a smartphone app.

Body and Lighting

Body and lighting harnesses manage exterior and interior lighting, door controls, and infotainment systems. With the rise of LED lighting and ambient interior designs, these harnesses are evolving to handle higher power loads. A U.S. automaker introduced adaptive lighting harnesses that adjust beam patterns based on driving conditions, enhancing nighttime visibility.

Dashboard and Cabin

Dashboard harnesses connect infotainment screens, digital clusters, and connectivity modules, catering to consumer demand for immersive in-vehicle experiences. A Japanese sedan featured a dashboard harness supporting a 12-inch touchscreen with 5G connectivity, transforming the cabin into a digital hub. This application is growing as vehicles become extensions of smart devices.

Regulatory Landscape

Regulations shape the automotive wiring harness market, driving innovation while ensuring safety and sustainability. Governments worldwide impose stringent standards to reduce emissions, enhance vehicle safety, and promote eco-friendly materials.

Emission Standards

Regulations like Euro VI, China VI, and Bharat Stage VI push automakers to adopt low-emission engines and electrified powertrains, increasing demand for high-voltage and lightweight harnesses. For instance, India’s BS-VI norms prompted two-wheeler manufacturers to upgrade wiring systems for better fuel efficiency, boosting the local harness market.

Safety Regulations

Safety standards, such as those from the National Highway Traffic Safety Administration (NHTSA) and European New Car Assessment Programme (NCAP), mandate robust wiring for airbags, anti-lock brakes, and ADAS. A North American supplier developed corrosion-resistant harnesses to meet NHTSA standards, reducing the risk of electrical failures in safety systems.

Environmental Compliance

Regulations like the EU’s End-of-Life Vehicles Directive encourage the use of recyclable materials in wiring harnesses. Manufacturers are adopting bio-based insulators and aluminum to comply with these mandates. A Scandinavian automaker achieved 95% recyclability in its harnesses, aligning with EU sustainability goals.

EV-Specific Standards

Governments are introducing EV-specific regulations, such as battery safety and charging standards, which impact wiring harness designs. For example, the International Electrotechnical Commission (IEC) standards for EV charging systems require harnesses with enhanced thermal stability. A U.S. EV manufacturer complied by integrating thermally optimized harnesses, ensuring safe fast-charging capabilities.

Challenges in the Automotive Wiring Harness Market

Despite its growth, the wiring harness market faces hurdles that test manufacturers’ resilience and ingenuity. Addressing these challenges is crucial for sustained progress.

Complexity of Vehicle Electronics

Modern vehicles feature intricate electrical architectures, with hundreds of sensors and ECUs demanding sophisticated harnesses. This complexity increases design and manufacturing costs. A European automaker faced delays in launching an autonomous SUV due to challenges in integrating high-speed harnesses, highlighting the need for streamlined solutions.

Cost Pressures

Fluctuating raw material prices, particularly for copper, strain profit margins. While aluminum offers a cost-effective alternative, its lower conductivity requires design adjustments. A mid-tier supplier in Asia mitigated this by optimizing harness layouts to reduce material usage by 10%, balancing cost and performance.

Supply Chain Disruptions

Global supply chain issues, exacerbated by geopolitical tensions and pandemics, disrupt the availability of components like connectors and terminals. A North American manufacturer faced production halts in 2023 due to semiconductor shortages, underscoring the need for diversified supply chains.

Skilled Labor Shortages

Wiring harness assembly remains labor-intensive, requiring skilled workers for precise crimping and bundling. In regions like South Asia, labor shortages have slowed production. A Southeast Asian supplier invested in semi-automated assembly lines, boosting output while reducing reliance on manual labor.

Environmental and Regulatory Compliance

Meeting stringent environmental regulations requires significant R&D investment in eco-friendly materials and processes. Smaller manufacturers struggle to keep pace, risking market share loss. A Latin American supplier partnered with a global firm to access sustainable material expertise, overcoming compliance barriers.

Future Opportunities

The automotive wiring harness market brims with opportunities as technology and consumer preferences evolve. Forward-thinking companies can capitalize on these prospects to drive growth.

Electric Vehicle Expansion

With EV sales projected to soar, demand for high-voltage wiring harnesses will skyrocket. Manufacturers can develop specialized harnesses for ultra-fast charging and next-generation batteries. A Chinese supplier is already prototyping 1000V harnesses for future EV models, positioning itself as a market leader.

Autonomous Vehicle Integration

Autonomous vehicles require redundant, fail-safe wiring systems to support sensor networks and computing units. Companies investing in high-speed, fault-tolerant harnesses will gain a competitive edge. A Silicon Valley startup partnered with a harness manufacturer to create AI-optimized wiring for its self-driving fleet, showcasing the potential of this niche.

Connected Car Ecosystems

The rise of connected cars opens avenues for smart wiring harnesses with IoT integration. These harnesses can enable over-the-air updates and predictive maintenance. A South Korean automaker is exploring IoT-enabled harnesses that monitor electrical health, reducing downtime and enhancing user experience.

Emerging Markets

Asia Pacific, Latin America, and Africa offer untapped potential due to growing automotive industries and urbanization. Manufacturers can establish local production to cater to these markets. A European firm set up a harness plant in Nigeria, capitalizing on the country’s rising vehicle demand and creating jobs.

Automation and Industry 4.0

Smart manufacturing technologies like automation, digital twins, and AI-driven design can enhance harness production efficiency. A German supplier adopted digital twins to simulate harness performance, reducing development time by 20%. These innovations will drive scalability and customization.

Conclusion

The automotive wiring harness market is alive and vibrant with opportunities stemming from electrification, connectivity, and sustainability. As vehicles get smarter and greener, so too do wiring harnesses, with significant advances needed to incorporate higher voltage, ADAS, and autonomous driving. We expect a bright future for the industry, not only facing the usual business VUCA (volatility, uncertainty, complexity and ambiguity), but with opportunities in electric vehicles (EVs) and connected ecosystems, especially in emerging markets. By deploying lightweight construction, modular designs, and smart manufacturing, all stakeholders in the supply chain can help create a dynamic, exciting path forward for this market. Let's stay engaged in this exciting journey as the automotive world hurtles towards 2033!

Post a comment